Governance

Governance | Risk Management | Ethics and Compliance | Executive Compensation | Tax Policy

FY2024 Executive Compensation

The company transformed company type from corporate with auditor to company with nomination committee by the approval of the 22nd annual general meeting on March 26th, 2024. The basic policy for compensation of directors, the executive officers (Shikko yaku), and the Executive Corporate Officers (Shikko yakuin) after transforming is as follows, with no changes from the current year’s policy. In addition, detail compensation will be determined by the Compensation Committee.

Compensation for Directors

- Highly transparent and objective

- Improvement of corporate value and compensation must interlock to share awareness of profit with shareholders.

- Contribute to ensuring and retaining global management team that satisfies accurate ability requirements to realize corporate vision

Compensation for the Executive Officers and the Executive Corporate Officers

- Highly linked to company performance, and highly transparent and objective

- Improvement of corporate value and compensation must interlock to share awareness of profit with shareholders

- Contribute to ensuring and retaining global management team that satisfies accurate ability requirements to realize corporate vision

The Company intends to continue to update our executive compensation program in a manner consistent with global company practices, and the Company will strive to have our management team and shareholders recognize that our compensation program is suited to the market and supports a positive impact on our business performance.

FY2023 Executive Compensation

① Compensation for Directors and Corporate Auditors

(a) Compensation for Directors

Compensation for Directors who serve concurrently as Executive Officers is described in “② Compensation for Executive Officers” below.

The basic policy regarding compensation for Directors who are not concurrently serve as Executive Officers is as follows.

- Highly transparent and objective

- Improvement of corporate value and compensation must interlock to share awareness of profit with shareholders

- Contribute to ensuring and retaining global management team that satisfies accurate ability requirements to realize corporate vision

For Directors who do not concurrently serve as Executive Officers, the Company pays base salary as fixed compensation up to the compensation limit as resolved at the General Meeting of Shareholders. For the purpose of securing diverse and talented human resources and further raising awareness of their roles, the Company grants some of such Directors stock-based compensation (one-yen stock options with service continuity conditions until 2020, and stock-based compensation where shares are delivered after vesting with service continuity conditions from 2021) up to the compensation limit as resolved at the General Meeting of Shareholders.

The details of stock-based compensation are described below in “② Compensation for Executive Officers,” “(b) Details,” “(i) Compensation Philosophy and Elements,” “(2) Stock-based Compensation,” and “<Stock Price-linked Compensation (Long-Term Incentive (LTI))>.”

The Compensation Committee, which is entrusted with the distribution of individual executive compensation by the Board of Directors, sets the compensation ratio, level, and mix of compensation for each Director who does not concurrently serve as Executive Officers, taking into account the appropriate ratios and levels in light of the above-mentioned basic policies, corresponding to the duties of the Directors. The Compensation Committee is composed of a majority of outside officers and is chaired by an Outside Director.

(b) Compensation for Corporate Auditors

For Corporate Auditors, the Company pays only base salary as fixed compensation that is not tied to performance, from the viewpoint of ensuring their independence. Compensation for Corporate Auditors is determined and paid after consultations among Corporate Auditors, up to the amount of the compensation limit as resolved at the General Meeting of Shareholders.

(c) Total Amount of Compensation, etc., by Category of Officer of Filing Company, Total Amount of Compensation, etc., and Number of Officers Eligible for Compensation, etc.

| Directors and Corporate Auditors | Headcount | Total Compensation (Millions of yen) | Total Amount of Compensation by Type (Millions of yen) | |||

|---|---|---|---|---|---|---|

| Monetary Compensation | Non-monetary Compensation, etc. | |||||

| Base Salary | Performance-linked Compensation (Short-term incentive) | Long-term incentives | ||||

| Continuous Service Conditional Stock-based Compensation | Stock-linked Conditional Stock-based Compensation | |||||

| Directors (excluding Outside Directors) | 1 | 1,629 | 92 | 122 | 323 | 1,092 |

| Outside Directors | 5 | 128 | 58 | - | 70 | - |

| Corporate Auditor (excluding Outside Corporate Auditors) | 1 | 20 | 20 | - | - | - |

| Outside Corporate Auditors | 3 | 18 | 18 | - | - | - |

(Note)

- As of the end of the current fiscal year, there were 5 Directors (including 4 Outside Directors) and 4 Corporate Auditors (including 3 Outside Corporate Auditors).

- Compensation for Directors includes compensation for the CEO who also serves as an Executive Officer.

- Amounts are rounded to the nearest million yen. Therefore, the total amount stated in each column may not correspond to the amount in the total compensation column.

- Of the non-monetary compensation in the table, continuous service conditional stock-based compensation includes Time-based Stock Options (TSOs), which are one-yen stock options, and stock-linked conditional stock-based compensation includes Performance-based Stock Options (PSOs). The fair value that is exercisable during the current fiscal year is calculated based on the closing stock price on the vesting date and other factors. Performance Share Units (PSUs) are not included because there were no units that vested during the current fiscal year. In addition, the amount to be charged to income for the current fiscal year is 513 million yen for internal Directors and 35 million yen for Outside Directors, which is applicable to stock options and units that have been granted.

- For Directors and Corporate Auditors who are non-residents in Japan, the currency of payment is converted into Japanese yen at the average exchange rate during the current fiscal year (JPY139.80 = USD 1.00).

- At the 16th Ordinary General Meeting of Shareholders held on March 29, 2018, that the maximum amount of compensation for Directors was resolved to be 2 billion yen per year (of which the maximum amount for Outside Directors was 400 million yen per year). At the conclusion of this Ordinary General Meeting of Shareholders, the Company had 5 Directors (including 2 Outside Directors).

- At the 19th Ordinary General Meeting of Shareholders held on March 30, 2021, and the maximum amount of stock-based compensation where shares are delivered after vesting for Directors was resolved within the framework of the amount described in Note 6 above and the total number of shares of the Company to be delivered by Directors was resolved within 2.7 million shares per year (of which, no more than 0.2 million shares are for Outside Directors). At the conclusion of this Ordinary General Meeting of Shareholders, there was 1 Director (Outside Directors are not eligible for grant) eligible for Performance Share Units (PSUs) and 6 Directors (including 5 Outside Directors) eligible for Restricted Stock Units (RSUs).

- At the Extraordinary General Meeting of Shareholders held on February 24, 2010, the maximum amount of compensation for Corporate Auditors was resolved to be within 12 million yen per month. At the conclusion of this Extraordinary General Meeting of Shareholders, the number of Corporate Auditors was 4 (including 3 Outside Corporate Auditors).

② Compensation for Executive Officers

The following describes the compensation program for our Executive Officers (A Director who also serves as an Executive Officer and other Executive Officers in this section are collectively referred to as “Executive Officers”). The composition of our Executive Officers (as of the end of the current fiscal year) is as follows. An Executive Officer who is also a Director is remunerated as a Director.

| Name | Position and responsibilities | Director | Executive Officer |

|---|---|---|---|

| Hidetoshi Shibata | Representative Director, President and CEO | ✓ | ✓ |

| Sailesh Chittipeddi | Executive Vice President, in charge of matters relating to Embedded Processing, Digital Power and Signal Chain Solutions Group | - | ✓ |

| Hiroto Nitta | Senior Vice President, in charge of matters relating to Information Systems Division (including One ERP Project) | - | ✓ |

| Shinichi Yoshioka | Senior Vice President and CTO, in charge of formulation of technology strategy and R&D policy for the Company | - | ✓ |

| Chris Allexandre | Senior Vice President and CSMO, in charge of Sales and Marketing | - | ✓ |

| Shuhei Shinkai | Senior Vice President and CFO, in charge of matters relating to Finance, Corporate Strategy, Accounting &Accounting & Control, Procurement Division, and Supply Chain Management Division | - | ✓ |

| Takeshi Kataoka | Senior Vice President, in charge of matters relating to High Performance Computing, Analog and Power Solution Group. (Co-Head) | - | ✓ |

| Vivek Bhan | Senior Vice President, in charge of matters relating to High Performance Computing, Analog and Power Solution Group. (Co-Head) | - | ✓ |

| Eizaburo Shono | Senior Vice President, in charge of matters relating to Production & Technology Unit | - | ✓ |

| Andrew Cowell | Senior Vice President, in charge of matters relating to Embedded Processing, Digital Power and Signal Chain Solutions Group (Mobility Infrastructure and Industrial Power) | - | ✓ |

| Julie Pope | Senior Vice President and CHRO, in charge of matters relating to Human Resources and General Affairs Division | - | ✓ |

This section includes:

- The overview of the compensation program and philosophy behind the design of the program for this Fiscal Year; and

- The type of compensation, the amount of compensation paid by type, and the total amount of compensation for each Executive Officer for the current fiscal year, which is covered by our disclosure.

Executive Officers of the Company have the broadest job responsibilities and policy-making authorities in the Company.

Executive Officers are responsible for maintaining our business performance and a highly ethical corporate culture, as well as for ensuring thorough compliance.

Accordingly, the Company aims to ensure transparency in our disclosure regarding executive compensation for not only our Directors, including the CEO, but also for our core members of the management team.

Therefore, the Company includes in our disclosure individual compensation for the CEO, CFO, other top three compensated executive officers (i.e, CSMO, Executive Vice President, in charge of matters relating to Embedded Processing, Digital Power and Signal Chain Solutions Group and Senior Vice President, in charge of matters relating to High Performance Computing, Analog and Power Solution Group.) respectively, as well as compensation for Directors with total compensation of at least 100 million yen that is required to be disclosed by law.

(a) Executive summary

The Company regularly update our compensation program for Executive Officers. The Company views compensation as one of essential management tools to accelerate the expansion of our business portfolio in the focus area of Automotive, and IoT and Infrastructure, where the Company has global presence and demonstrate strong market competitiveness.

When establishing compensation program and setting compensation levels, the Company uses global and Japanese companies in the semiconductor and other related industries as our peer companies for benchmark comparisons. Each year, The Company performs a market comparison of our executive compensation packages and update them based on the results of that comparison. In response to global trends in strengthening corporate governance at listed companies, And the Company designs appropriate and competitive compensation packages as a global company to attract and retain talented Executive Officers who can drive our business.

Our compensation program is designed to include performance-linked compensation to encourage Executive Officers to think and act in the best interests of shareholders in both the short- and long-term. A significant portion of our Executive Officers’ total annual compensation is paid as performance-linked and stock price-linked compensation. Short-term incentives (STIs), which are performance-linked compensation, are tied to our short-term performance, and stock price-linked compensation (LTIs) are tied to our long-term performance. The Company also believes that our compensation program holds our Executive Officers accountable for direct financial performance and overall market competitiveness of the Company.

(b) Details

(i) Compensation Philosophy and Elements

The basic philosophy regarding compensation for Executive Officers is as follows.

- Highly linked to company performance, and highly transparent and objective

- Improvement of corporate value and compensation must interlock to share awareness of profit with shareholders

- Contribute to ensuring and retaining global management team that satisfies accurate ability requirements to realize corporate vision

In addition, the current compensation mix consists of the following:

- Base salary as fixed compensation

- Performance-linked compensation focused on achieving shorter-term financial and strategic objectives (Short-Term Incentives)

- Stock-based compensation where shares are delivered after vesting as stock price-linked compensation to motivate management to increase shareholder value (Long-Term Incentives)

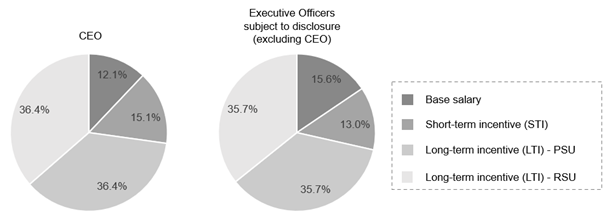

The Company believes that our current program is consistent with practices in the global and Japanese domestic markets, as well as the interests of our stakeholders. The ratio of each type of compensation in the total compensation is set based on consideration of the appropriate ratio, according to market comparisons, global trends, and roles and performance of each Executive Officer. In addition, in order to tie long-term performance to our executive compensation and realize strong alignment between shareholders and management team, the Company has been promoting a compensation strategy that emphasizes long-term incentives compared to many Japanese companies, and the Company has set the ratio of stock-based compensation to total compensation as a majority proportion of total compensation.

(1) Cash Compensation

Base Salary

Base salary is the core compensation that reflects the market value of particular roles and responsibilities in the organization and is a reward for actual responsibilities, competencies, and experience of each Executive Officer.

This compensation is paid as a fixed amount based on the scope of responsibilities and the expected contribution to the Company. This compensation is a fundamental element of executive compensation, and is set at a level that invites and ensures retention of competent Executive Officers, and motivate them to drive global business expansion.

This compensation will be adjusted annually in consideration of market salary increase rates, our performance and individual performance.

Performance-linked Compensation (Short-Term Incentive (STI))

Short-term incentives (STIs) are paid to Executive Officers as motivation and reward for overall company financial performance as well as assessments of the individual performance of Executive Officers for each fiscal year. This compensation is a crucial element of our executive compensation program and is focused on motivating Executive Officers to contribute to the achievement of performance goals.

This compensation is based on one-year company performance, which consists of performance of Automotive Business segment, and IoT and Infrastructure Business segment. In order to evaluate business expansion and the profitability thereof, this is evaluated by using certain indicators, including the following:

- Revenue (growth rate)

- Operating margin (Non-GAAP basis)

Evaluation indicators and targets are set annually. And the payout amounts based on business performance are approved by the Compensation Committee.

(2) Stock-based Compensation

Stock Price-linked Compensation (Long-Term Incentive (LTI))

Long-Term Incentives (LTIs) are variable compensation with an evaluation period of 1 year or more and are generally paid in a manner that corresponds to the value earned by shareholders. The role of Long-Term Incentives is to align economic incentives for Executive Officers with the long-term performance of the organization and the long-term orientation of our shareholders.

Beginning in 2021, current Long-Term Incentives are paid through Stock-based compensation where shares are delivered after vesting, and the actual earnings received by Executive Officers are determined based on stock price growth and total shareholder return (TSR) over a 3-year period.

Specifically, Long-Term Incentives consists of Performance Share Units (PSUs) that determine the number of units according to our TSR and deliver our shares as well as Restricted Stock Units (RSUs) that are subject to continued service. Of these, PSUs are designed with TSR added to our performance indicators in order to tie PSUs more closely to maximizing medium- to long-term corporate value and strengthening awareness and activities to contribute to our stock price.

The number of units to be granted will be determined based on the simple average of the closing of our shares price on the Tokyo Stock Exchange during the 3-month period immediately before the month of the resolution by our Board of Directors, based on the base amount of compensation set for each Executive Officer in proportion to their responsibilities and percentages. The composition rate of the compensation base amount for PSUs and RSUs is 50% to 50%.

Meanwhile, in the event that a person eligible for grant falls under any of the causes stipulated by the Board of Directors, such as certain misconduct stipulated by the Board of Directors, all or part of the unvested units shall be forfeited. In addition, if, after vesting, it is found that such events or the act causing such events occurred before vesting, the grantee shall refund, without compensation, all or part of the shares issued in respect of such units or an amount equivalent thereto, if deemed appropriate by the Company.

| Type | Purpose | Basis | Composition Ratio |

|---|---|---|---|

| Performance Share Units (PSUs) | Increase Executive Officers’ willingness to contribute to stock price growth and corporate value | TSR | 50% |

| Restricted Stock Units (RSUs) | Recruit and retain outstanding talented human resources by reinforcing the linkage between compensation and stock price and sharing the profits with shareholders | Tenure | 50% |

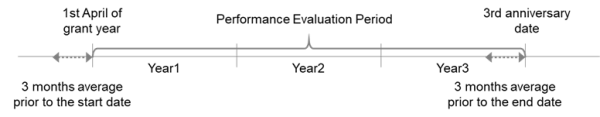

[PSU]

Grantees are granted a number of units calculated according to the following formula:

Number of PSUs = base amount of PSU compensation (before performance evaluation) which our Board of Directors has determined to grant to each grantee / simple average of the closing price of our shares on the Tokyo Stock Exchange for the 3 months immediately before the resolution by the Board of Directors

Subsequent to the date the Company determines (in principle, the 3 years anniversary date after the grant date), we will issue a number of shares equal to such vested number determined as follows, taking into account the performance requirements for that period.

| Performance Indicators | TSR: Determined by comparing the companies which constitute SOX (Philadelphia Semiconductor Index) and TOPIX (Tokyo Stock Price Index) as well as a group of companies (Renesas Peers) that the Company selects in light of the industry, company size, business model, etc. | ||||||||||||

| Performance Evaluation Period | 3 years from April 1 of the year in which the PSUs were granted | ||||||||||||

| TSR Growth Rate of the Company | (Average stock price for the 3 months before the end of the performance evaluation period (*1) | ||||||||||||

| Method of Determining Issued Shares |

|

[RSU]

Grantees are granted a number of units calculated according to the following formula:

Number of RSUs = the base amount of RSU compensation for the 3 years (however, for Outside Directors, 1 year) that our Board of Directors decided to grant to each grantee / the simple average of the closing price of our shares on the Tokyo Stock Exchange during the 3 months immediately preceding the month of resolution by our Board of Directors

As a general rule, one-third of the units vest each year after the grant date (however, for Outside Directors, all of the units vest on 1 year after the grant date) and the Company will issue a number of shares equal to the number of vested units.

(ii) Comparator Group (FY2021 and thereafter, as of the end of the current fiscal year)

The Compensation Committee reviewed comparable companies in compensation to better understand program design and competitive compensation levels. Given that the Company is operating our business globally, the Company selected the comparable companies not only in Japan, but also from the United States and Europe, both of which are our primary business areas and where the global executive compensation programs are functioning. The Company referred to the 3 key global regions with an appropriate balance, and set future performance targets, and established a compensation program with the aim of promoting the achievement of business and financial indicators both globally and regionally.

Comparator groups in compensation include high-tech companies headquartered in Japan, which are either or both competitors in human resources acquisition or competitors in the same industry as viewed by investors. At this stage, the correlation between the revenue level and the executive compensation level is not so strong in Japan, so the Company has selected Japanese companies from a wide range of revenue levels. For US and Europe, the Company selected semiconductor companies considering revenue level and market capitalization. The disclosed personal compensation data of comparable companies in compensation is supplemented by market compensation data (Mercer LLC and Aon survey).

| Companies with headquarters, etc. in Japan (Number of comparable companies: 13) | Companies with headquarters, etc. in the US (Number of comparable companies: 12) | Companies with headquarters, etc. in Europe (Number of comparable companies: 4) |

|---|---|---|

| Sony Group Corporation Toshiba Corporation Mitsubishi Electric Corporation Tokyo Electron Limited Advantest Corporation DISCO Corporation Hitachi, Limited. Panasonic Holdings Corporation Olympus Corporation Trend Micro Incorporated. DENSO Corporation TDK Corporation Murata Manufacturing Corporation | Analog Devices, Inc. Texas Instruments Inc. Microchip Technology Inc. Advanced Micro Devices, Inc. Applied Materials, Inc. Broadcom Inc. Lam Research Corp. Marvell Technology, Inc. Micron Technology, Inc. Qualcomm, Inc. KLA Corp. ON Semiconductor Corp. | STMicroelectronics N.V. NXP Semiconductors N.V. Infineon Technologies AG ASML Holding N.V. |

(iii) Analysis of Compensation Decisions

(1) Total Compensation

The Compensation Committee reviewed both the overall package and the compensation by type before the final determination of Executive Officers’ compensation. The target information includes total cash compensation (base salary and STI), stock-based compensation amount, total compensation amount (base salary, STI, and stock-based compensation), and the impact of proposed compensation on other compensation elements. When determining the amount of compensation, compensation mix and incentives for Executive Officers, the Compensation Committee reviewed each position, role, and status of service, including career history, in relation to corporate performance and individual performance and our medium- to long-term value creation, in accordance with our basic philosophy of compensation. The Compensation Committee assessed whether overall compensation was consistent with the purposes of the program.

Based on this comprehensive review, the Compensation Committee determined that the compensation levels and compensation mix for the current fiscal year were appropriate.

Base Salary

The amount of base salary paid to Executive Officers for the current fiscal year was determined after deliberations by the Compensation Committee, taking into account the role of each position and the related employment markets (Japan, US or UK).

Performance-linked Compensation (Short-Term Incentive (STI))

The STI target amount for the Executive Officers in the current fiscal year that the Company disclosed is shown below.

| Name | STI (Target amount: Millions of yen) | Base Salary (Base amount: Millions of yen) | Percentage of STI for Base Salary |

|---|---|---|---|

| Hidetoshi Shibata | 122 | 97 | 125.0% |

| Shuhei Shinkai | 31 | 34 | 90.0% |

| Sailesh Chittipeddi | 83 | 87 | 95.0% |

| Vivek Bhan | 59 | 78 | 75.0% |

| Chris Allexandre | 52 | 70 | 75.0% |

(Note) The amounts are rounded to the nearest million yen. For overseas officer, the currency for payment is converted into Japanese yen at the average exchange rate during the current fiscal year (JPY139.80 = USD 1.00). The percentage of STI for Base salary is calculated based on amounts before rounding.

Provisional STI payments are calculated based on the revenue (growth rate) and operating income margin (Non-GAAP basis) of whole company.

This scheme is the same as the scheme for employees, and it is a mechanism for sharing incentives with employees.

The final amount of payment will be determined upon deliberations by the Compensation Committee based on the provisional STI payment determined by the scheme described above, our performance, various requirements other than financial performance, and other factors for the fiscal year.

Stock Price-linked Compensation (Long-Term Incentive (LTI))

The following table shows the grant level for each Executive Officer based on the calculation of the number of Stock-based Compensation granted to Executive Officers that the Company disclosed in the current fiscal year.

| Name | Stock-based Compensation (base amount of grant level: Millions of yen) | ||

|---|---|---|---|

| Total | PSU (base amount of grant level) | RSU (base amount of grant level) | |

| Hidetoshi Shibata | 586 | 293 | 293 |

| Shuhei Shinkai | 149 | 74 | 74 |

| Sailesh Chittipeddi | 461 | 231 | 231 |

| Vivek Bhan | 280 | 140 | 140 |

| Chris Allexandre | 350 | 175 | 175 |

(Note) The table sets forth the base amount of the annual grant for each Executive Officer (amounts are rounded to the nearest million yen and, for overseas officers, the currency of payment is converted into Japanese yen at the average exchange rate during the year (JPY139.80 = USD 1.00)). The actual amounts vested are set forth in the table below under “(iv) Total Amount of Consolidated Compensation for Each Executive Officer Subject to Disclosure.”

The compensation mix for Executive Officers disclosed by the Company for the current fiscal year is shown below.

The percentage of the variable portion is greater than the current general situation of executive compensation in Japan because it rewards Executive Officers for company performance and individual performance.

(Note) Each compensation element is based on a target base amount before reflecting performance (as of December 31, 2023)

(2) Performance Evaluation for the current fiscal year (Non-GAAP Basis)

Revenues (Non-GAAP basis) and operating income margin (Non-GAAP basis) both decreased during the current fiscal year.

Total shareholder return grew 139.5% on a 3-year average, outpacing the median of TOPIX constituent companies and outpacing the median of SOX-constituent companies.

Revenue (Non-GAAP basis)

- Our revenue decreased 2.2% in FY2023 compared with the previous fiscal year.

- Revenue by business unit is as follows:

- Revenue in the Automotive Segment in FY2023 increased 7.8% compared with the previous fiscal year.

- Revenue in the IoT and Infrastructure Segment in FY2023 decreased 9.6% compared with the previous fiscal year.

Operating margin (Non-GAAP basis)

- Our operating margin (Non-GAAP basis) in FY2023 decreased 3.1pts compared with the previous fiscal year.

- Operating margin by business unit (Non-GAAP basis) is as follows:

- Operating margin (Non-GAAP basis) in the Automotive Segment in FY2023 increased 0.4 pt compared with the previous fiscal year.

- Operating margin (Non-GAAP basis) in the IoT and Infrastructure Segment in FY2023 decreased 5.3 pts compared with the previous fiscal year.

Total shareholder return (TSR)

- The 3-year average of TSR growth rate used to evaluate the performance of PSOs in FY2023 was 139.5%, higher than the median of TOPIX constituent companies and also higher than the median of SOX-constituent companies.

- Payout% based on the TSR is as below.

| TSR of Renesas | Group | %ile Max: 90%ile or above Target: 50%ile Min: less than 25%ile | Payout% Max: 100% Target: 50% Min: 0% | Weight | Final Payout% Vs Grant value Max: 100% Target: 50% Min: 0% | Final Payout% Vs PSO Target value Max: 200% Target: 100% Min: 0% |

|---|---|---|---|---|---|---|

| 139.5% | SOX | 82.1%ile | 86.8% | 50% | 93.4% | 186.8% |

| TOPIX | 96.3%ile | 100% | 50% |

(Note) Since the number of PSO to vest can’t exceed the number granted, 200% of PSO Target value had been granted then the number of PSO to vest was calculated multiplying the number of grants by 0-100% as a result of performance evaluation.

Overview of performance results

| 1 year | 3 years | ||

|---|---|---|---|

| Revenue (Non-GAAP basis) | -2.2% | ||

| Automotive Segment | +7.8% | ||

| IoT and Infrastructure Segment | -9.6% | ||

| Operating margin (Non-GAAP basis) | -3.1pts | ||

| Automotive Segment | +0.4pt | ||

| IoT and Infrastructure Segment | -5.3pts | ||

| Total Shareholder Return (TSR) | +139.5% | ||

(Note)

- Revenue and Operating Margin (Non-GAAP basis): Disclosed results on a Group-consolidated and Non-GAAP basis

- TSR performance evaluation period: April 1, 2020 to March 31, 2023

- TSR calculation: (Average stock price for the 3 months before the end of the performance evaluation period

- Average stock price for the 3 months before the day before the commencement date of the performance evaluation period

+ Total dividends per share related to dividends of retained earnings with a record date during the performance evaluation period)

/ Average stock price for the 3 months before the day before the commencement date of the performance evaluation period - The Company does not pay dividends from retained earnings during the performance evaluation period.

(3) Individual Performance Evaluation Results (MBO (Management By Objective))

The CEO’s performance was evaluated by the Nomination Committee for his overall contribution to our performance.

For Executive Officers that the Company disclosed other than the CEO, the CEO considered the elements described below in evaluating individual performance.

- Mr. Shuhei Shinkai served as CFO and the CEO focused on our financial management

- Mr. Sailesh Chittipeddi served as General Manager of Embedded Processing, Digital Power and Signal Chain Solutions Group and the CEO focused on the financial performance and strategic positioning of the business unit

- Mr. Vivek Bhan served as Co head of High Performance Computing, Analog and Power Solution Group and the CEO focused on the financial performance and strategic positioning of the business unit

- Mr. Chris Allexandre served as CSMO the CEO focused on our sales and marketing activities

(iv) Total Amount of Consolidated Compensation for each Executive Officer Subject to Disclosure

| Name | Amount of Compensation (Millions of yen) | Total Compensation (Millions of yen) | |||

|---|---|---|---|---|---|

| Base salary | Performance-linked Compensation | Stock Price-linked Compensation | |||

| Long-term Incentives (LTI) | |||||

| Short-term Incentive (STI) | Continuous Service Conditional Stock-based Compensation | Stock-linked Conditional Stock-based Compensation | |||

| Hidetoshi Shibata | 92 | 122 | 323 | 1,092 | 1,629 |

| Shuhei Shinkai | 33 | 31 | 80 | 274 | 418 |

| Sailesh Chittipeddi | 86 | 83 | 438 | 1,542 | 2,149 |

| Vivek Bhan | 78 | 59 | 144 | 0 | 281 |

| Chris Allexandre | 70 | 52 | 251 | 896 | 1,270 |

(Note)

- Amounts are rounded to the nearest million yen. Therefore, the total of the amounts listed in each column may not correspond to the amount in the total compensation column.

- “Base salary” represents the amount paid in the current fiscal year. “Performance-linked Compensation” represents the amount of short-term incentive (STI) payments for the period under evaluation, which is the current fiscal year. “Stock Price-linked Compensation” represents the amount vested in the current fiscal year.

- An Executive Officer who is also Director (the CEO) are compensated as a Director.

- For overseas officers, the currency for payment is converted into Japanese yen at the average exchange rate during the current fiscal year (JPY139.80 = USD 1.00).

(v) Benefits and Welfare

Executive Officers are eligible to receive various benefits equal to those of our other employees, excluding severance benefits. Those benefits include social insurance, such as health insurance and welfare pensions, accident insurance, commuting expenses, and rights to use group insurance.

(vi) Pay Ratio (Compensation Ratio)

The median of total annual compensation of all employees (other than the CEO) for our current fiscal year was 6 million yen. The CEO’s total annual income was 1,629 million yen. Based on this information, the ratio of the CEO’s total annual compensation to the median of total annual compensation of all employees was approximately 272 to 1.

The following methodologies and significant assumptions were used to determine the median of total annual compensation of all of our employees and to calculate the total annual compensation of the median employee:

- December 31, 2023 was selected as the date (record date) for determining the median employee

- Our employees as of the record date consisted of approximately 21,000 employees working for the Company and its consolidated subsidiaries (excluding those on leave that are not expected to return to work)

- To determine the median employee, the Company used information about base salaries and incentives paid to all employees. The monthly salary is calculated on an annualized basis for full-time employees who have a service period of less than 1 fiscal year or who had a non-paid holiday during a 1-year period

The CEO’s total annual compensation is the amount shown in the column “(iv) Total Consolidated Compensation for Each Executive Officer Subject to Disclosure” above (Base salary + STI + LTI).

③ Voluntary Compensation Committee

To ensure the appropriateness of compensation and transparency of the decision-making process, the Company has established a Voluntary Compensation Committee as an advisory body to the Board of Directors. The Compensation Committee is composed of a majority of Outside Officers and is chaired by an Outside Director.

Compensation Committee members are as follows:

- Chairman: Selena Loh Lacroix (Outside Director)

- Member: Hidetoshi Shibata (President and CEO)

- Member: Noboru Yamamoto (Outside Director)

- Member: Tomoko Mizuno (Outside Corporate Auditor)

During the current fiscal year, the Compensation Committee held a total of five meetings. The compensation structure, individual compensation level (including payout amount of performance-linked compensation and grant amount of stock-based compensation) for Directors and Executive Officers are decided based on market data and compensation advisor’s (Willis Towers Watson) advice by the Voluntary Compensation Committee, The granting of stock-based compensation are decided by the Board of Directors after deliberations by the Compensation Committee.